There is no question that systematic investing plays an important role in the public equities markets: Quant trading strategies now encompass 27% of all U.S. stock trades by investors, up from 14% in 2013. Even investors who have become well known for taking a traditionalist approach, such as Bill Miller and Paul Tudor Jones, now rely on artificial intelligence and machine learning to improve their decision-making.

But when it comes to the private investment asset classes (namely private equity and venture capital), technology-driven quantitative investing is virtually nonexistent.

CircleUp is leading the charge to change this paradigm by bringing a truly data-driven, technology-powered approach to private markets. We’re starting in the consumer packaged goods (CPG) and retail industries, because we believe they are particularly ripe for this kind of change. But ultimately, we believe the path we are currently pioneering in CPG will extend to all sectors of private investment.

What is Helio?

Helio is our internal data science and machine learning platform, and the foundation of our systematic investing strategy in private markets. Helio collects and analyzes disparate data from more than 100 public and proprietary sources to understand and predict the future business success of CPG and retail companies across the United States. Data about more than 1.2 million companies is organized into composite models that assess each one on a number of key investment criteria, including industry positioning and the relative strength of financial performance, brand, management team, product uniqueness and quality, and distribution footprint.

The goal of Helio is to improve upon traditional private investment due diligence process that is limited by human heuristics, while adding a level of efficiency, consistency and scale to the process that only machine learning can accomplish.

The Rare Art of Foresight

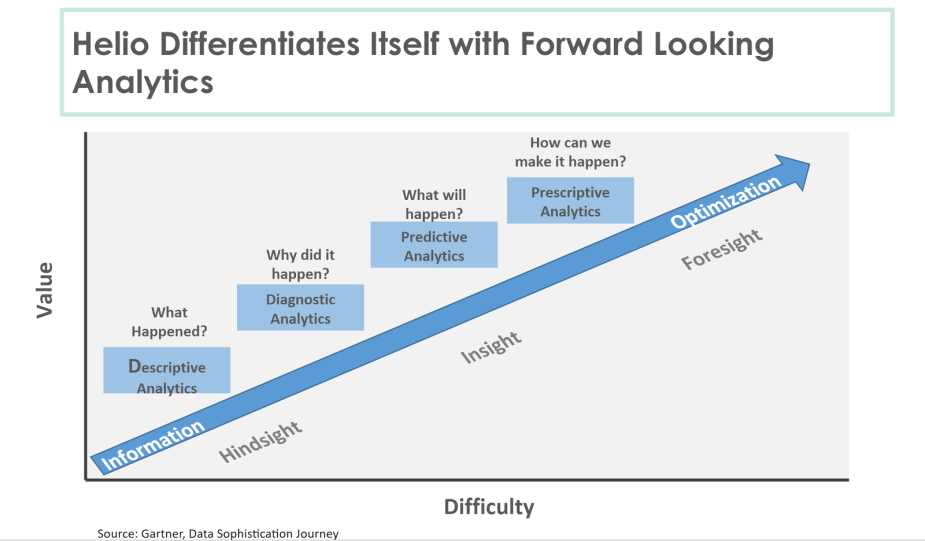

To understand Helio from an analytics perspective, it is helpful to look at Gartner’s data sophistication curve (shown below.)

This curve shows the value that different analytic capabilities provide relative to the difficulty in their implementation. “Descriptive analytics” include reporting and dashboarding capabilities that recap what happened in the past. They are very often paired with “diagnostic analytics,” which attempt to explain why the past happened. Most companies are very comfortable using data for these kinds of applications, looking back to analyze cause and effect.

However, as we move beyond hindsight and into the art of foresight, even the most data-savvy companies are out of their comfort zone. In fact, Gartner estimates that only 13% of companies use “predictive analytics,” which use existing data to train models for forecasting and extrapolation about the future.

Even rarer are “prescriptive analytics,” which Gartner estimates only 3% of companies use, to make automated recommendations and provide actionable outcomes to a person or business. In the case of private investing, this would be an “invest” or “do not invest” outcome.

CPG: An Ideal Entry Point

Forward-looking analytics require an abundance of data to tune and optimize the models, which is one reason why the public equities markets are early adopters of systematic investing: The stock market requires companies to supply detailed information about their businesses on a quarterly basis. It is also why many pundits argue that systematic investing is not applicable to the private markets, where detailed, accurate, and up-to-date data is largely unavailable.

But while this may be true in many industries, it is much less the case for CPG and retail companies. For one thing, SKU level retail sales data exists for most products, whether they’re from publicly-traded or privately-held CPG brands. This alone provides us with an incredibly rich dataset to track and analyze. Food and beverage companies are required by law to disclose detailed information about their ingredients and nutritional components, providing more data that can be factored in when assessing consumer preferences and trends. And most all consumable brands like to tout the unique and natural ingredients of their products, as shoppers care more and more about transparency. Furthermore, unlike in industries such as technology, the business models in CPG and retail are very uniform — a company manufactures and distributes a product, which retailers then buy and sell to people. This is advantageous for prescriptive analytics because the consistency in business models also means consistency in the growth curves of these businesses.

This all means that by using Helio, our ability to predict successful CPG and retail outcomes, even for companies with limited operating history, can be incredibly accurate. This creates tremendous opportunity for us on the deal-sourcing side: We can spot high-growth companies early in their development, potentially before even the company itself knows its own potential. Among other advantages, this allows us to be proactive and targeted in sourcing deals, as opposed to being reactive to banks bringing us deals, as is often the case in the private markets.

Imagine being able to approach a shampoo brand that Helio has identified as ten months away from a potential uptick in consumer demand, and therefore on the cusp of needing significantly more working capital requirements. It is of great value to both the financial sponsor’s returns, and the shampoo company’s growth, to identify these opportunities early on.

The Real “Black Box”

When I talk with private equity professionals, they often tell me that companies partner with them — and LPs pay them — because of their industry expertise and networks. They argue that datasets alone cannot evaluate the vision of the management team running the company. They argue that successful investing is an art, not a science, only made possible through years of experience evaluating businesses and people.

Much of that is certainly true. There are a number of things that humans continue to do much better than machines and algorithms, in investing and elsewhere. But, it’s important to acknowledge there are also important limitations to the purely human approach. Many of these, we believe, can be significantly ameliorated by incorporating technology into investment workflows.

For example, much has been written about confirmation bias, in which investors look for information that supports their original thesis about an investment rather than seeking out information that contradicts it. It prevents investors from being objective about decisions as new information becomes available. A number of other biases have also been shown to exist among investors, such as gender bias and anchoring, where, because of past experiences, someone relies too heavily on one factor in making an investment decision.

This indicates that despite all the skepticism and fear about the “black box” nature of machine learning, human decision-making can be the real “black box” because of its limited processing power, cognitive biases, and emotional influences. In practice, rules-based investment algorithms can guarantee the consistency of logic and process in a way humans simply cannot.

Rethinking the Status Quo

We should also consider why companies and investors pay PE and VC professionals for their industry expertise and network. At the end of the day, the ultimate goal of all parties involved is for portfolio companies to grow. But what if systematic investing can improve the probability of growth in other, more effective ways?

Many firms say, seemingly as a badge of honor, that they look at 500 to 1,000 deals a year and spend 85% of their time sourcing new deals. They spend another 5–10% of their time executing new deals. This means that these firms only spend 5–10% of their time actually supporting their portfolio companies’ growth. Find that hard to believe? Just ask a CEO how many days a year she spends with each investor, outside of the mandatory board meetings. It is not many.

With systematic investing applications like Helio, not only can a fund provide due diligence on hundreds of thousands of companies with limited human intervention, but we can quickly gain the conviction necessary to close transactions in days instead of the more traditional four months. The net result is that we find the highest potential companies — and almost all of our resources, and those of the portfolio company, can be focused on post-close growth.

Systematic investing strategies and tools like Helio will certainly change the operating model for PE and VC firms. When less time is spent on mindless sourcing or routine execution, firms should be able to invest significantly more time into working directly with their portfolio companies while maintaining the quality of oversight required. This also frees up resources that firms can deploy in alternative ways to drive growth and efficiency, such as providing more shared services for their portfolio companies to leverage. If Helio can eliminate 85% of an investor’s current job (the sourcing component), the firm can instead dedicate that time to helping companies. Or better yet, the firm can reframe its priorities altogether, and hire different investors that are perhaps more equipped to help post-investment.

And in the longer term, due to the scalability and cost advantage of systematic investing, perhaps the fee structure in private equity can pivot away from the standard “2 and 20” to a lower rate, thus expanding market participation. In many ways, this would parallel the rise of ETFs and their much lower investment fees versus traditional public equity active managers.

The Future

Quantitative technology stands to benefit companies just as much as it benefits investors. Just as CircleUp has prospered in leveraging the power of Helio, in the future we can directly extend its advantages to the companies in which we invest.

For example, companies will be able to use Helio to prove to potential retail partners that their brand outperforms the competition, and therefore will likely be a success if placed on the shelves (CircleUp is already getting requests from our companies to do this.) Companies could also use Helio’s prescriptive analytics to assess which geographical markets they should focus their time on to maximize sales. Benefits like these would provide a meaningful impact to companies at nearly every stage of growth, well beyond simply the capital invested during a funding round.

Informational advantages are nothing new, and their applications in statistics, machine learning, and artificial intelligence are well documented: It’s why the Oakland A’s could be competitive despite having an inferior payroll, why quant hedge funds have outperformed the average hedge fund by 80 basis points per year for the last 5 years, and why a computer could beat a world-renowned player in a game of Go.

It’s simply inevitable that information advantages, fueled by technology, will come to play a prominent role in the private equity markets as well. Helio is the first major step in this direction.

Zen Water

A water brand with an estimated revenue of $10-$20M (a +407% YoY increase)

Recess

A carbonated drink brand with an estimated revenue of $10-$20M (a +104% YoY increase)

Mad Tasty

A water brand with an estimated revenue of $1-$5M

Shine Water

A water brand that is in 3,000 retail doors (a +329% YoY increase)

All Wello

A juice brand with an estimated revenue of $1-$5M (a +89% YoY increase)

By understanding how these trends will impact the CPG landscape, you can position your business for success.

To learn more about Helio or get in touch, visit heliodata.com.